Income-tax-Return-of-Income-and-Assessment-Procedures (1) - Section-Assessee-Revised return | PubHTML5

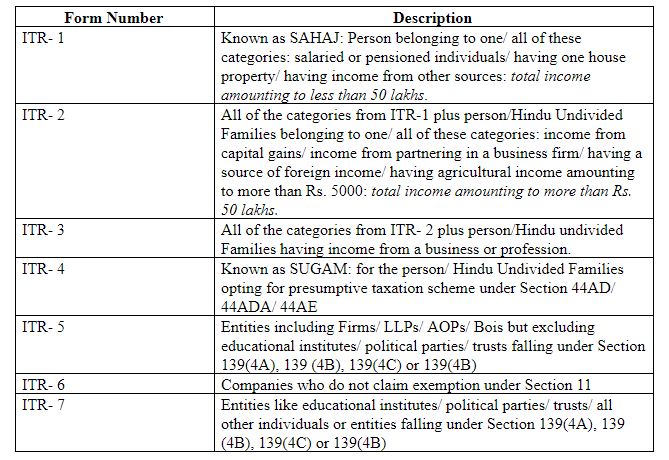

The Central Board of Direct Taxes has recently released the new ITR-4 Form, which is supposed to be used by individuals who are earning business income for the Assessment Year 2018–19. ITR-4

A A A M & CO LLP on Twitter: "As a community of professionals, we hereby write this representation with your good self with optimism requesting the extension of the designated due