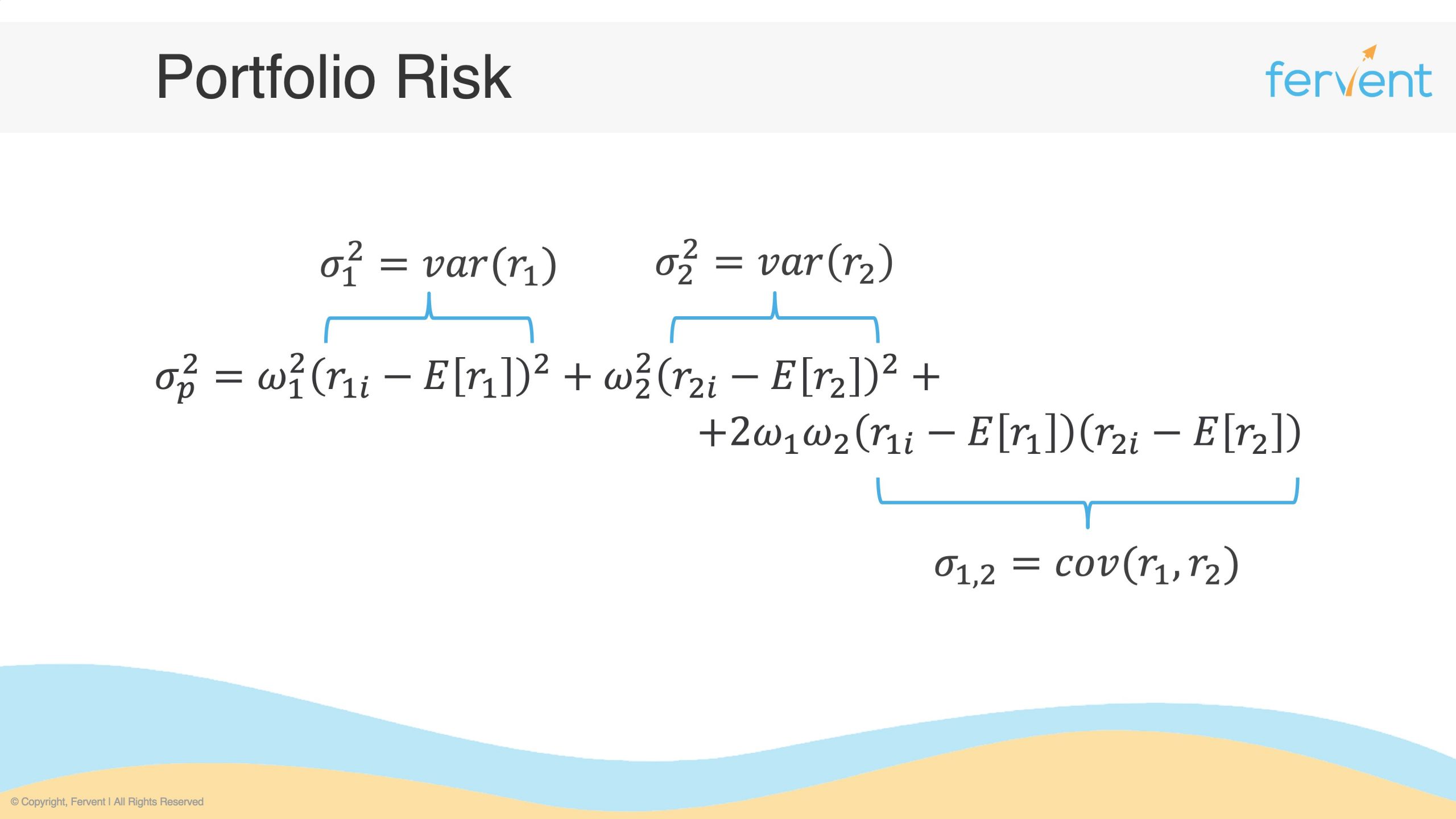

How to Calculate Portfolio Risk From Scratch (Examples Included) - Fervent | Finance Courses, Investing Courses

How to Calculate Portfolio Risk From Scratch (Examples Included) - Fervent | Finance Courses, Investing Courses

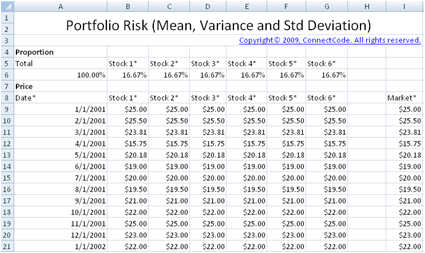

Calculate the risk on expected return of the following portfolio assuming the portfolio consists of the following securities and market values - Quant - AnalystForum

A faster way to calculate portfolio risk, and remember it too | Financial Modeling Tutorial - YouTube

How to Calculate Portfolio Risk From Scratch (Examples Included) - Fervent | Finance Courses, Investing Courses

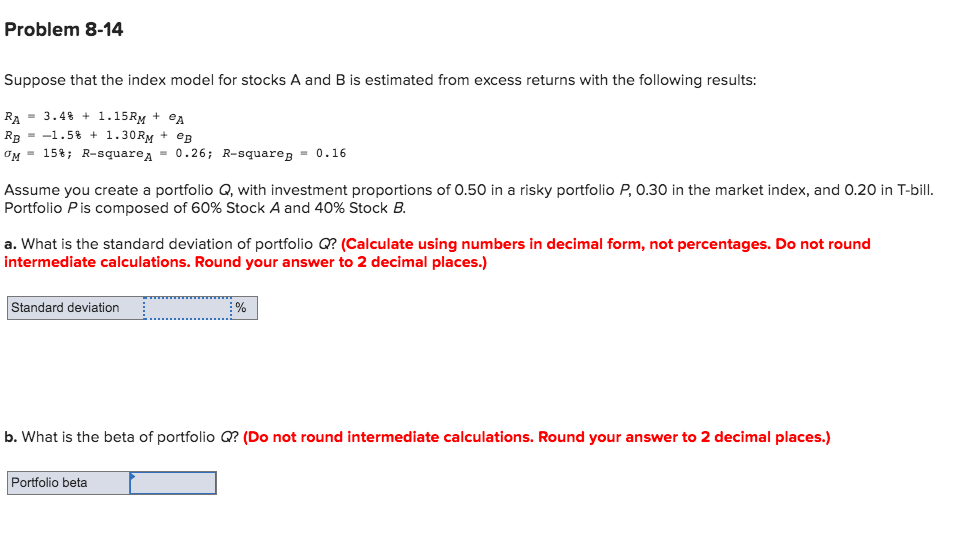

SOLVED: portfolio consists of three securities are a5 follows: Stock A Stock B Stock C Expected Return 80% Risk Proportion Invested 0% The correlation coefficient between the different securities is as follows:

How to Calculate Portfolio Risk From Scratch (Examples Included) - Fervent | Finance Courses, Investing Courses

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)