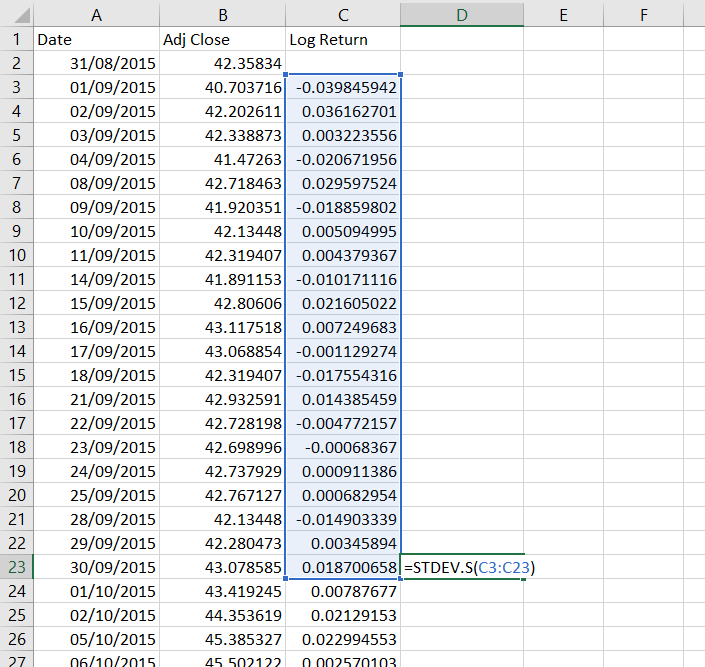

How to calculate Log return , daily return and Holding period return for stock market data - YouTube

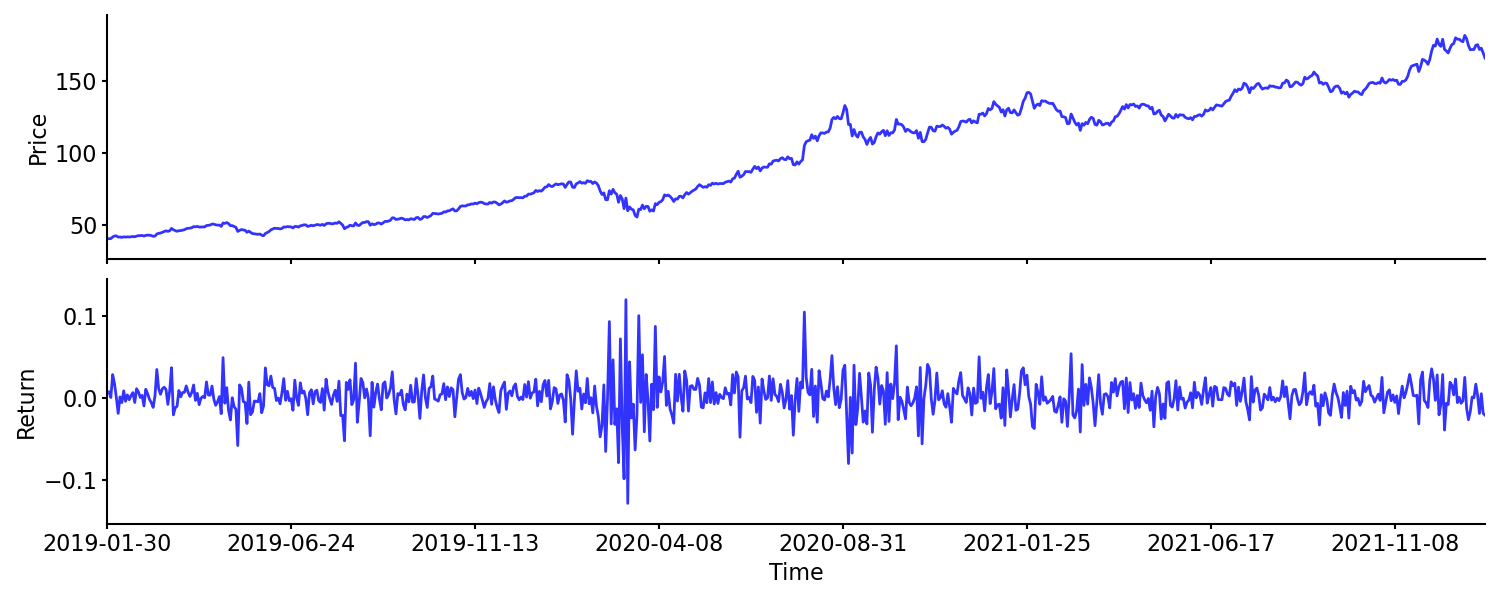

Why stock returns are calculated in Log scale? - General - Trading Q&A by Zerodha - All your queries on trading and markets answered

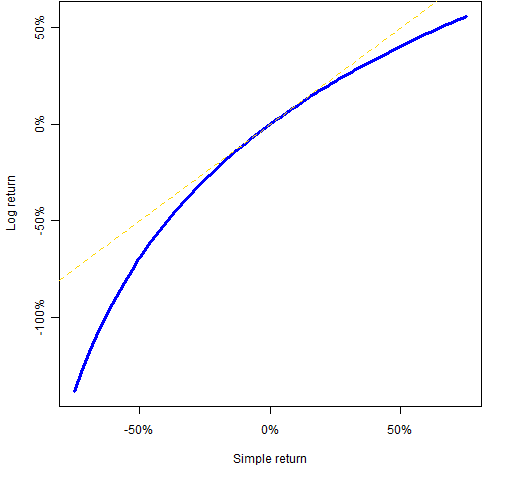

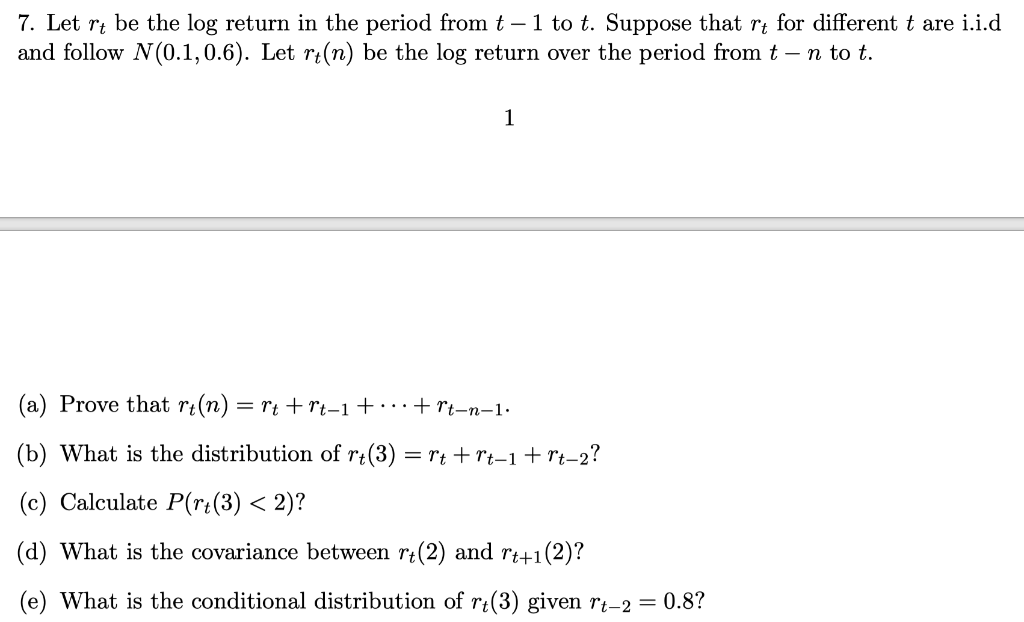

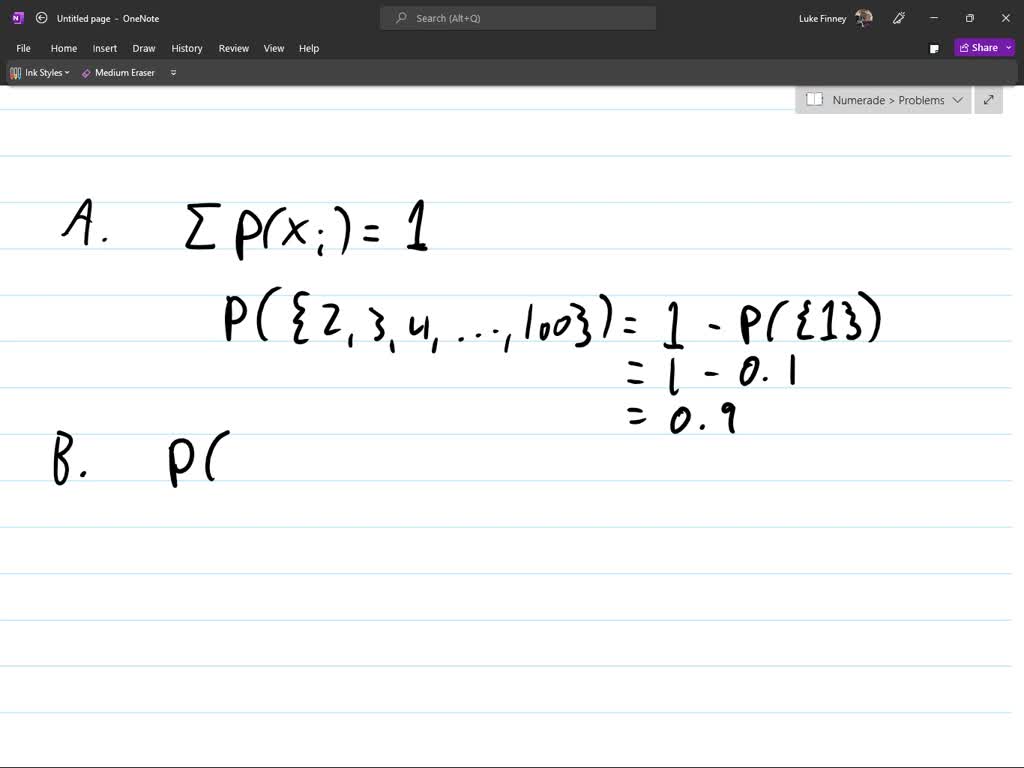

SOLVED: Suppose log return r ∼ N(0, 0.12 ). (a) Find E(R) and Var(R). (b) Find Pr(R < −0.1). (c) What is the probability that a simple two-period return is less than

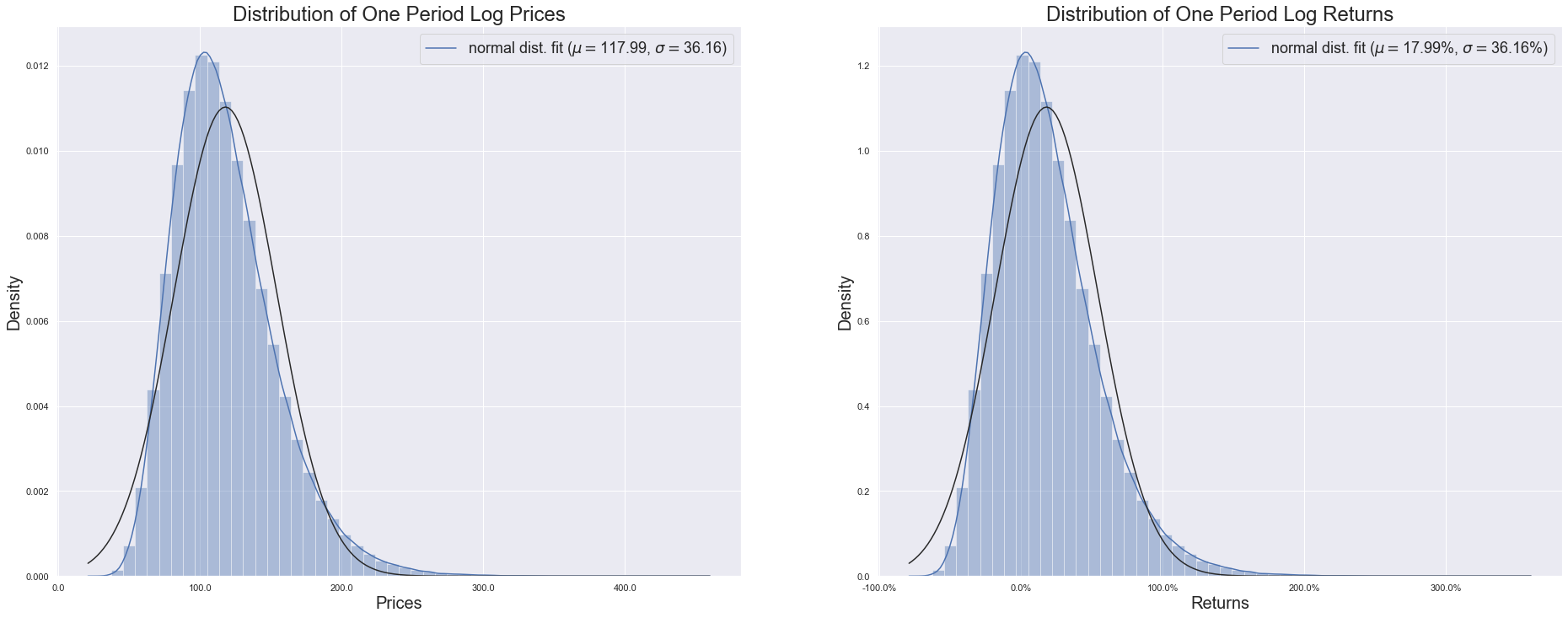

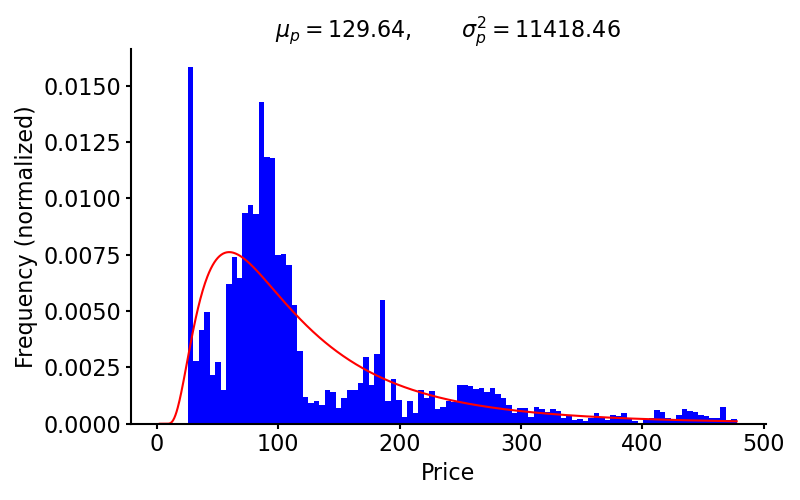

Histograms of log returns for the entire period and for the days after... | Download Scientific Diagram